HS Classification – Commodity codes

Every product has a Harmonised System (HS) code – often referred to us as commodity code.

Essentially these codes determine what your product is and helps classify goods for import and export so you or a third party can complete relevant customs declarations and other paperwork for you when moving goods crossborder.

You will need this code to check if there are any duties to pay or if there are any duty reliefs that apply.

Where do you get them?

In line with the harmonised international system, you should identify and make a record of HS codes for each of your products.

Codes can be found on several website but below are two websites for the UK and EU tariffs.

UK Site – www.gov.uk/trade-tariff

EU Site – TARIC Consultation (europa.eu)

When importing into the UK and EU the codes are 10-digits and for export 8-digits. To a point these codes are universally recognised so you should find the same codes on both websites.

Lets use the UK website as an example of how to find a HS code.

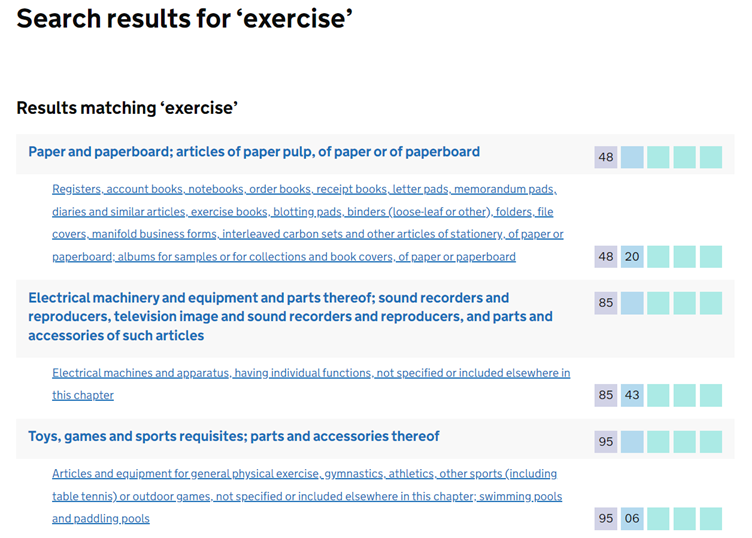

Through the UK government website search for your product category lets use exercise equipment as an example.

First thing is to search for a key word – ie “exercise” this gives us different categories to see what fits our product best. To the right you can see first 4 digits of 8 digit code which is 9506,

If we expand this we can see the full HS code:

Once we have the right HS code you can see duty rates and any preferences that may apply to the product.

If you struggle to find the correct code or unsure you have the correct one please feel free to contact our team to see how we can help.